Inside the steamy, sticky world of Massimiliano Musina’s Clubhouse Media Group’s promise of “revolutionizing content creation” and penny stock dump (OTC: CMGR) where the lines between a Hollywood script and a Wall Street scandal blur into a story as sensational as it is suspect.

Starring

Max Musina, our charismatic yet controversial film producer, knows a thing or two about putting on a good show.

Amir Ben-Yohanan is the mastermind with a penchant for real estate and questionable leadership tactics.

The Setting

The world of penny stocks—a playground for the bold and the brave, or the reckless and the ruthless, depending on who you ask. CMGR’s stock, once a star on the rise, finds itself caught in a plot twist worthy of a thriller.

The Plot Unfolds

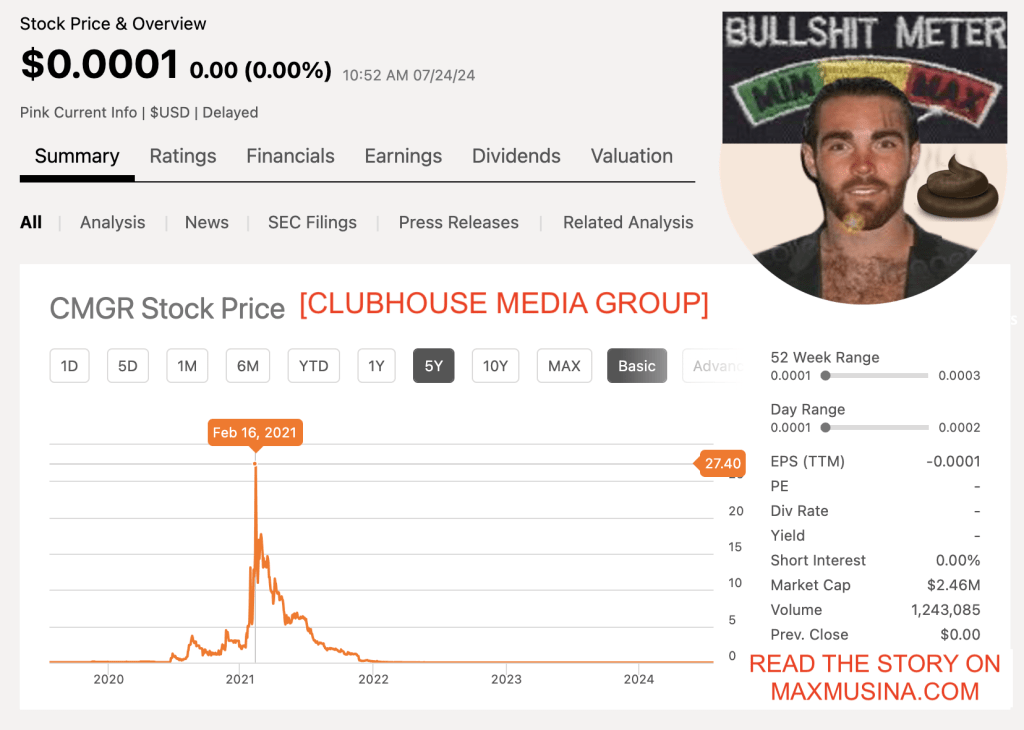

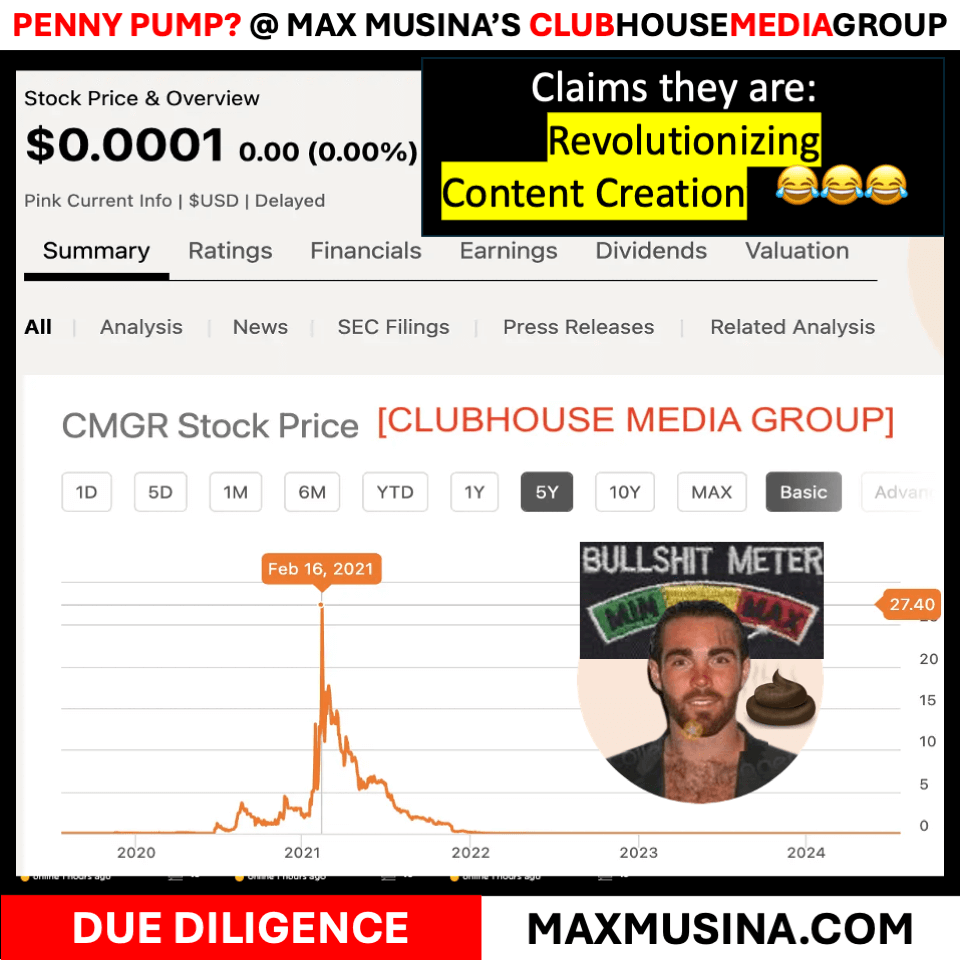

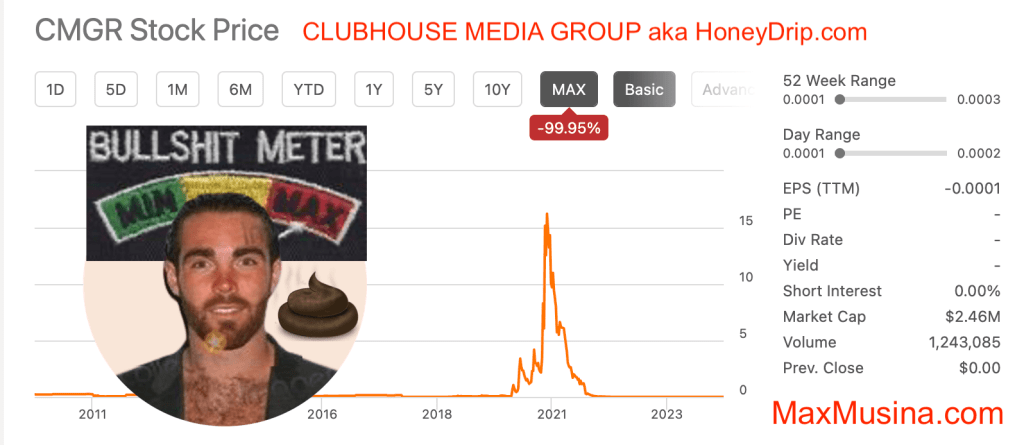

On February 16, 2021, the stock of Clubhouse Media Group soared to an astronomical $27.40, casting a spotlight on the company like a premiere at a Hollywood gala. But behind the scenes, the narrative was far less glamorous. This dramatic spike in stock price wasn’t a sign of blockbuster success but a classic marker of what looks like a “pump and dump” scheme.

No doubt their excuse was, “it wasn’t me.” Here’s why: Clubhouse Media Group, valued at $742 million, seemingly capitalized on market name confusion with the popular audio-sharing app Clubhouse, leading to a spike in its stock due to investors mistaking it for the other app. According to an SEC filing, dear Massimiliano Musina got short-changed, taking home only $100,000 for the year, paid in quarterly installments. Still not bad for one day’s work.

This price surge in value was fueled by misleading press releases that deceived or confused investors about the nature of the company’s connections to the well-known social media platform. This scenario highlights a complex weave of high-stakes investments and ethical challenges in the fast-paced world of digital media startups.

Cinematic Parallels

Imagine a scene where Max, with his Hollywood flair, pitches the next big hit—not a film, but a stock.

Cut to investors, wide-eyed, buying in droves as the hype builds.

But as quickly as the climax reaches its peak, the plot crumbles—the stock plummets, leaving a trail of financial debris and bewildered investors.

What Clubhouse Media Group Really Does

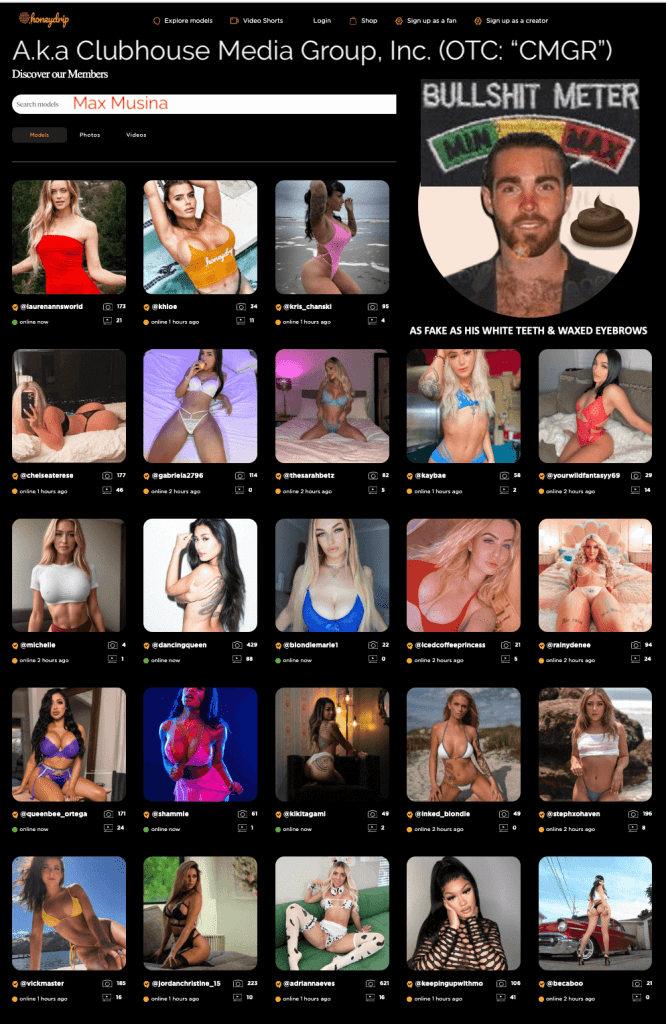

Contrary to its lofty name and the grandiose claims of revolutionizing social media, Clubhouse Media Group’s main operation revolves around HoneyDrip.com.

This website features adult content under the guise of ‘social media content creation.’ HoneyDrip.com hosts profiles of women, often scantily clad, offering x-rated photos, videos, and live interactions more akin to adult entertainment than traditional social media fare.

The site brands these individuals as ‘content creators,’ though the nature of the content stretches the term to its limits.

A Peek “Inside the Girls” at Musina’s Clubhouse

Welcome to the steamy, sticky world of HoneyDrip.com, where Clubhouse Media Group’s promise of “revolutionizing content creation” slips and slides into something far more scant and wet.

Picture this: inside the “innovative” walls of Max Musina’s digital empire, the content is less about crafting narratives and more about curating nocturnal distractions.

At Musina’s HoneyDrip. They’re not just dropping clothes but curating sticky, wet content! The Company’s motto might as well be “less fabric, more likes,” the idea of a bikini is just a fleeting suggestion, often discarded faster than a bad plot twist in a B-movie.

Here, the girls engage in what could best be described as a sartorial striptease, turning the art of minimal attire into a full-time pursuit. In this digital emporium of the scantily clad, underwear does not stay on for long—they’re just a tease before the inevitable reveal. It’s all in a day’s work because when you’re part of Musina’s master plan, who needs scripts or fabric when you have ambition and a live feed?

Financial Drama: Analyzing the Pump and Dump

The Spike: The single-day high was like the opening night of a blockbuster film, full of promise and excitement. However, the nature of this peak—sharp, sudden, and unsupported by fundamental improvements in the company’s actual business—suggests artificial inflation.

The Dump: Following the peak, the stock price crashed almost as dramatically as it rose, typical of a pump-and-dump in which the initial promoters sell off their holdings at peak prices, leading to a rapid decline.

Revelations from the Daily Mail Newspaper

Max Musina, connected with the rapidly ascending and descending Clubhouse Media Group, boasted about potential riches from shares in a venture resembling platforms like OnlyFans.

However, under the leadership of CEO Amir Ben-Yohanan, the company has faced serious allegations. According to a report from the Daily Mail dated May 8, 2021, Ben-Yohanan, aged 48, is accused of inappropriate conduct towards teenagers residing at the company’s mansions. Critics have described him as ‘very aggressive’ in orchestrating dates for his younger influencers.

The Daily Mail shed light on the darker undertones of CMGR’s operations, reporting on Amir’s and Max’s roles in allegedly scouting and wrangling women for HoneyDrip.com, whom they termed as ‘content creators’ but whose roles resembled those of strippers more than anything else.

The article titled “REVEALED: CEO who ‘bullied TikTok influencers, forced them to go on dates and made jibes about their periods’ is an ultra-private real estate agent who shuns ALL social media but wanted to cash in on the modern-day ‘Gold Rush,” accused Amir of fostering an environment that exploited these young women, pushing them into uncomfortable situations under the pretense of career advancement in ‘social media.’

Audience Reaction:

Investors, initially caught up in the spectacle, soon realized they were extras in a financial fiasco. Much like a Hollywood illusion, the promise of transformative social media innovation was unmasked, revealing a more mundane reality of speculative trading.

Critics’ Review

Financial analysts and savvy spectators might note that CMGR’s narrative had all the classic signs of a pump and dump:

Pre-Event Buildup: Like a well-marketed movie premiere, the stock was hyped to attract maximum attention.

Sudden Shift in Plot: The stock’s rapid decline mirrored the twist in a thriller where the hero is revealed to be the villain.

Post-Climax Denouement: With the stock price hovering near $0.0001, investors faced the hard truth behind the glamorous facade.

Closing Scene:

As the dust settles on the drama of Clubhouse Media Group’s stock saga, the market and perhaps regulatory authorities may call for a sequel—a thorough investigation into Max and Amir’s dealings.

Meanwhile, investors are left pondering the age-old adage, “All that glitters is not gold,” especially in the high-stakes world of penny stocks.

In conclusion, Clubhouse Media Group’s foray into the public market, spearheaded by characters fit for a film noir, serves as a cautionary tale of what happens when Hollywood storytelling meets Wall Street reality. It’s a reminder that in the theater of finance, the line between fact and fiction is often as thin as a stock ticker.

Anonymous Executives

In the flashy world of Clubhouse Media Group, the cast of characters populating the executive team reads like a lineup from a mysterious drama, where everyone knows the roles but not the full names. As the plot thickens around their business’s operations and ethical boundaries, omitting surnames from the executive team’s public profiles begs a deeper look into the motives behind this anonymity.

Is it because Clubhouse Media Group is a company that straddles the volatile lines between innovative social media ventures and adult entertainment and presents its leadership without last names, ostensibly to foster a casual, approachable corporate culture? Yet, this stylistic choice might be a strategic maneuver to obscure deeper, darker motives.

At first glance, omitting surnames appears as a modern, friendly approach, perhaps intended to cultivate a close-knit, startup-like atmosphere within the company. However, considering the reputations of key figures such as Amir and Max, this absence of full identities serves a dual purpose: distancing the executive team from their online histories and the controversies they carry.

The Shadows of Reputation

Amir and Max’s Notorious Past: With both figures having reputations tarnished by allegations of unethical behavior—ranging from financial manipulations to morally dubious talent management—their desire to minimize searchable ties to CMGR becomes clearer. Amir’s strategies in finance and Max’s recruitment tactics for HoneyDrip.com, which allegedly involve wrangling dubious talent for adult content, cast long shadows.

Potential Regulatory Red Flags: For a company under the scrutiny of SEC regulations, choosing to obscure full names could be seen less as a style choice and more as a protective measure. In industries where transparency is key to maintaining public trust and regulatory compliance, such anonymity could raise suspicions about the company’s operations and governance.

Financial Drama and Speculations

Given the volatile history of CMGR’s stock and the speculative nature of its business model, the leadership’s anonymity could be perceived as a strategy to insulate personal reputations from the financial repercussions of their business decisions.

Using a platform like HoneyDrip.com, which blurs the lines between adult entertainment and social media, adds another layer of complexity, potentially necessitating a degree of separation between the personal identities of CMGR’s leaders and the platform’s operations.

Further Analysis of the Stock Chart

The provided stock chart for Clubhouse Media Group, Inc. (CMGR) clearly illustrates a dramatic peak in the stock price on February 16, 2021, followed by a significant and sustained decline. This pattern highly indicates a “pump and dump” scheme, a manipulation strategy prevalent among penny stocks.

1. Single-Day High:

• On February 16, 2021, the stock price hit an unusually high point, reaching as much as $27.40, according to the data point on the chart.

• This spike in price is unusually sharp and short-lived, characteristic of a pump and dump where the price is artificially inflated through exaggerated or fraudulent promotions.

2. Subsequent Decline:

• Immediately following the peak, the stock price rapidly declines, stabilizing at much lower levels, hovering close to $0.0001 through much of 2024.

• This drastic fall suggests that once the initial hype (pump) subsided, the stock was sold off in large quantities (dump), leading to a collapse in price.

3. Volume and Market Reaction:

• The chart indicates a significant trading volume on the spike day, which is typical in pump-and-dump schemes where a high volume of shares is traded as the price peaks, and insiders offload their holdings.

• Post-dump, the volume appears to normalize. Still, the price remains depressed, reflecting a lack of confidence and possibly the realization among investors of the stock’s actual value without artificial hype.

Implications

• Investor Impact: Investors who bought the stock at or near the peak would have faced substantial losses, as the value of CMGR stock plummeted shortly after. This type of market activity can lead to significant financial damage for uninformed or speculative investors caught by the allure of a quick profit.

• Regulatory Concerns: Such drastic fluctuations are likely to attract regulatory scrutiny. Agencies such as the SEC (Securities and Exchange Commission) often investigate stocks that exhibit extreme volatility to determine if manipulation or fraudulent activities were involved.

• Company Reputation: For Clubhouse Media Group, the implications of such stock behavior could damage investor trust and corporate image. It raises questions about the company’s financial stability and the legitimacy of its business operations.

• Broader Market Impact: Incidents like this can affect the broader perception of penny stocks and may make investors more cautious, potentially making it harder for legitimate small-cap companies to raise capital through equity markets.

What This Means

The stock performance of CMGR on February 16, 2021, serves as a textbook example of what appears to be a pump-and-dump scheme. Such events underscore the importance of investor diligence and the need for regulatory frameworks to monitor and act on potential market manipulation.

For CMGR, moving forward from such a drastic financial event will require transparent communication with stakeholders and possibly restructuring business strategies to regain trust and stabilize its market position.

Analyzing the share distribution and stakeholder interests in Clubhouse Media Group, Inc. provides deeper insight into the company’s financial dynamics, especially considering the backgrounds and reputations of major players like Amir Ben-Yohanan and Massimiliano (Max) Musina.

Share Distribution and Control

• Amir Ben-Yohanan: Holds a staggering 67.39% of the equity, valued at approximately $3 million. This vast majority stake not only suggests that Amir is the primary beneficiary of the company’s financial dealings but also indicates that he has significant control over company decisions and the strategic direction of Clubhouse Media Group.

• GS Capital Partners LLC: With 3.699% of the equity, translating to about $181,674, this stake, while significantly smaller than Amir’s, still represents a notable external interest in the company.

• Harris Tulchin: Possesses 2.982% of the equity, valued at roughly $146,475. As a stakeholder with a background in entertainment law, Harris’s involvement may provide some legal savvy to the operations.

• Massimiliano Musina (Max): Has a 2.353% stake worth about $115,593. While smaller, this stake is non-negligible and suggests Max’s financial involvement aligns with his operational role within the company.

Financial and Operational Implications

1. Amir Ben-Yohanan’s Dominance:

• Amir’s majority ownership implicates him as the primary financial beneficiary of the company’s operations, including any profits generated from activities (e.g., the HoneyDrip platform). His significant control could mean that strategic decisions, including potentially controversial ones, are influenced heavily by his directives.

• The allegations against Amir and his approach to running the company could reflect his larger strategy to maximize personal gains, possibly at the expense of other shareholders or ethical considerations.

2. Max Musina’s Role:

• Despite being a major public face of Clubhouse Media Group, Max’s financial stake is relatively small compared to Amir. This setup might suggest that while Max acts in capacities that grant him visibility (perhaps leveraging his self-styled Hollywood persona), his influence on the company’s financial decisions could be limited.

• The perception of Max as someone who picks up trashy girls for Amir or the CMGR and will do “anything for a buck” aligns with this minor stake. It suggests that his actions within the company may be driven more by personal gain (whether through salary or smaller-scale stock benefits) rather than substantial equity-based incentives.

3. Stakeholder Dynamics:

• The distribution of shares indicates a significant imbalance in power and potential earnings. While having less control, stakeholders like GS Capital Partners and Harris Tulchin still hold enough of a stake to be impacted significantly by the company’s overall performance and reputation.

• The dynamics among these stakeholders could lead to potential conflicts, especially if decisions made by Amir and potentially Max do not align with minority shareholders’ interests.

Conclusion

The analysis of Clubhouse Media Group’s share structure and major shareholders reveals a company where financial control and influence are highly concentrated in the hands of its CEO, Amir Ben-Yohanan. This concentration raises questions about corporate governance, accountability, and the alignment of interests between majority and minority shareholders.

Meanwhile, Max Musina’s smaller stake juxtaposed with his public persona as a key player in the company highlights a potentially strategic use of his image to further the company’s public relations or operational fronts without corresponding financial power. This configuration underscores the complexities and potential misalignments within the company, hinting at why its operational strategies may sometimes seem as sensational and controversial as a Hollywood script.

Max and Amir—the dynamic duo of disaster! One pretends to make movies, the other pretends to sell dreams, but in the end, all they leave their clubhouse media group investors a big plate of niente!

Ah, Clubhouse Media Group—where ‘content creation’ is just code for ‘we outta ideas, so let’s find some girls to take off some clothes and call it innovation!

Massimiliano Musina, this guy who turns pennies into problems and stock prices into spaghetti—it’s always tangled up and al dente, but never quite cooked right!

Ah, Max Musina, the maestro of trashy stocks and trashier content—he’s-a like da Fellini of financial flops! Bravo, Max, keep-a making those masterpieces… of mediocrity!

hahaha this sounds so much like Max Musina. He has no real experience launching businesses. He takes endless meetings about meetings that he calls “work.” He will then claim you’re ‘partners’ in your business and try to shake you down for payment.